Overview

Mahindra Insurance Brokers Ltd. (MIBL) set off on the journey of changing lives and the face of the insurance sector in India in the year 2004. MIBL is an 100% subsidiary of Mahindra & Mahindra Financial Services Ltd. (Mahindra Finance).

MIBL was granted a Direct Broker's License by the Insurance Regulatory and Development Authority (IRDA) in May 2004 for undertaking direct insurance broking in Life and Non-Life businesses. Since then, MIBL has empanelled itself with various public and private insurance companies to offer customised solutions to customers. In September 2011, it was granted a Composite Broker’s license by the IRDA, thus foraying into the Reinsurance Broking business. As a Total Insurance Risk Solutions provider, MIBL plays an integral role in the Risk Management portfolio of customers.

Mahindra Insurance Brokers is one of the few insurance broking companies in India to have been awarded the prestigious ISO 9001:2015 Certification for Quality Management Systems. Since inception, MIBL has been committed to understanding the customers’ insurance needs and risk profile, and providing innovative, cost-effective, customised solutions to ensure total customer satisfaction. MIBL’s role, in short, encompasses various activities, right from risk profiling to claims administration for customers. MIBL aims to play a predominant role in the insurance broking industry with a focus on giving more value to customers, innovative solutions, superior services, a professional team, and corporate social responsibility.

MIBL provides direct insurance broking for Commercial and Retail customers and offers a range of Life and Non-Life products. MIBL’s Direct division ensures every person at every doorstep is insured, while paybima.com, its online platform, enables customers to compare and buy a policy online. With Sajhedaari (a PoSP model) MIBL is not just insuring the hinterlands of India but also creating self-employment opportunities. Apart from the regular products, MIBL also customises solutions like Group Credit Protection Plan, a customised, cost-effective life insurance solution offered to retail customers of Mahindra Finance who have availed auto and tractor loans.

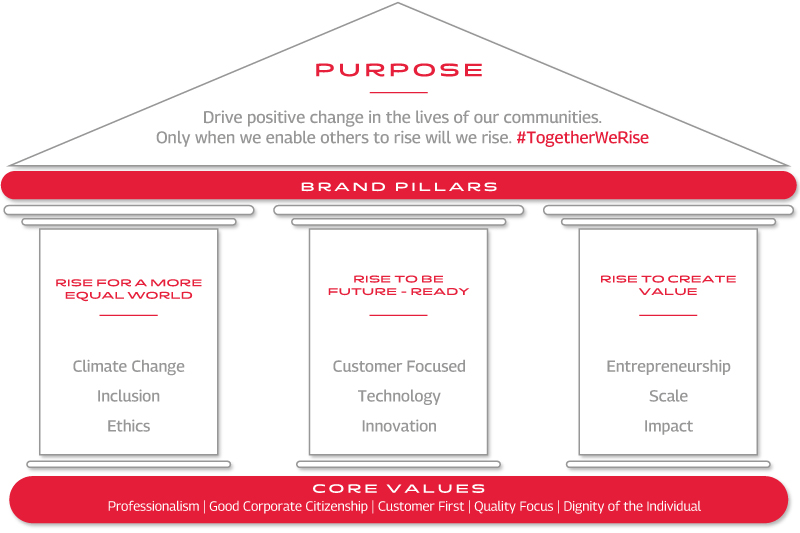

Rise Philosophy

Why Mahindra Insurance

We are committed to bring our wealth of knowledge to you. As an individual, corporate or a business, we safeguard your future and ensure your growth. With more than 18 years of experience as insurance brokers and a combined experience of 300 plus years in the insurance sector, we have partnered with over 1000+ corporates to chart their growth story. Our ingenious team of experts offer advice to individuals and corporates. For individuals, we have solutions to help protect life, health and motor. As for Corporates, right from insuring assets, offices, factories, employees, supply chain, digital footprint, legal liabilities, financial uncertainties, our expert team ensures peace of mind every step of the way.

Expert Advisory

Our experts devise solutions that revolve around our customers, their business and future endeavours.

Know More

Unmatched Service

From unbiased advice during policy buying to end-to-end support during the time of claims, we are with our customers every step of the way.

Know More

Wide Reach

Right from the smallest towns to the megacities, we are present everywhere.

Know More

Customised Solutions

Every customer is unique and so are their needs. That’s why we collaborate with insurers to customise solutions.

Know MoreWe take various initiatives to ensure peace of mind for our customers and stakeholders.

When natural calamities arise, with Project SETU we act as a bridge between our Motor Insurance Service Providers (MISP), customers and insurers. It is our disaster action response which offers expert claim assistance and express claim settlement during challenging times. Because for us, restoring our customers’ smiles is not our job but our responsibility. No matter how tough the times get, we promise to be with our customers every step of the way.

‘Vishwas’ is the ultimate testament of our relationship with customers where stories of our claims assistance, trust and commitment come alive. We facilitate the claims process for our customers by helping them understand the processes, documentation etc. Vishwas is a reflection of our unwavering support to ensure a smooth claim journey for individual customers and corporates.

Journey of MIBL

Mahindra Insurance Brokers Limited (MIBL) started with a small capital of USD 100,000, and today it’s clocking Rs. 2434 crore in FY20/21. What started as a 14 people company in 2004 has now over 700+ happy employees, catering to 3 lakh villages across India and touching the lives of over 15 million individuals and 1000+ corporate customers. MIBL has gone beyond boundaries with a presence in over 40 countries. With each passing year, our roots grow stronger, our branches grow wider, and we keep setting new milestones!

Milestones

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2007

2005

2004

Are you a video person?

Get to know us and learn more about insurance by checking out our videos.

Find us on YoutubeOur Partners