- 01 Overview

- 02 Classes of Business

- 03 Why Mahindra Insurance Brokers

- 04 Business Presence

- 05 Our Team

- 06 Contact Us

- For the domestic market, we fetch capacity and expertise of international reinsurers for the Indian insurers which include simple and complex risks

- Developing international business for Insurers/Reinsurers based in India, as well as sourcing capacity for insurers based in various countries

- Innovation and niche product development for the market

- Risk and claims management services

Overview

Mahindra Insurance Brokers Limited (MIBL) started operations in 2004. After establishing retail and direct business, MIBL obtained a composite license to start the reinsurance business in 2012.

Since then, it has been an exciting journey with Indian clients, insurers, group clients, reinsurers worldwide and the reinsurance broking fraternity across the globe. As a Reinsurance Intermediary, MIBL arranges reinsurances with reputed, ably rated and financially sound reinsurers to help insurance companies protect their capital and balance sheet.

We provide end-to-end solutions from policy issuance to capacity to our group clients through our wide network of insurers, reinsurers and brokers worldwide.

Our team brings in domain knowledge, product expertise and international network, which is ably supported by a team of professionals handling processes, documentation and claims. We are an organization that is always adaptable to change and constantly strive to offer our expertise, innovation and skills to our clients.

We have launched our reinsurance division in Dubai on 3rd October 2024. To be based out of Dubai’s International Financial Centre (DIFC), the global financial center of Dubai, this division will act as a regional hub and cater to the Middle Eastern and North African (MENA) markets.

Role of MIBL

- Mega Package Policies

- Industrial All Risk Policies

- Erection All Risks Insurance

- Contractors All Risks Insurance

- Marine Cum Erection Insurance

- ALOP and DSU

- Boiler Insurance/DOS

- Bulk/Project/Oil and other types of cargo

- Rejection Insurance

- Hull & Machinery Insurance

- Protection & Indemnity Insurance

- Liabilities - Charterers, Stevedors, Shipowners, Freight Forwarders etc.

- Fine Arts & Specie

- Terrorism & Political Violence

- Jewellers Block and Terrorism

- Global Programs

- Event Insurance

- Cash Management

- Kidnap & Ransom

- Directors & Officers Liability

- Professional Indemnity

- Tech E & O

- Commercial General Liability

- Public & Product Liability with recall

- Hull All/Hull War Risks

- Combined Single limit

- Hull Deductible

- Excess War Liability

- Aviation Liabilities: Products, Premises, Hanger keepers, Ground Handlers, Refuellers, Airport operators

- Aviation PA & LOL

- Satellite Insurance

- Quota Share

- Surplus Treaty

- Quota Share cum Surplus

- Fac Obligatory Treaty

- Multiline Proportional

- Net Account XL

- Whole Account XL

- Marine Excess of Loss

- Aviation Excess of Loss

- Stop Loss Covers for specialty classes

- Pure Fac Excess of Loss Cover

- Liability Treaties – Proportional & Non-Proportional

- Marine & Energy Excess of Loss

- The reinsurance team is headed by an expert in the reinsurance business.

- Ably assisted by professionals in reinsurance broking, and underwriting experience in the Middle East, Far East and India.

- The team has a diverse background and is experienced in handling both Treaty and Facultative Reinsurance

- Expertise in handling various lines of business such as Aviation, Energy, Marine, Liability, Property, Terrorism, etc

Classes of Business

FACULTATIVE

Property/Engineering

Marine (Hull & Cargo)

Specialty Lines

Casualty and Financial Lines

Aviation & Aerospace

TREATIES

Proportional

Non Proportional

Why Mahindra Insurance Brokers

Technical Advice and Consultancy

Structuring Fac and Treaty solutions for insurers

Excellent relations with major Reinsurers, Lloyds brokers and ability to secure best terms

Identifying the right lead-Reinsurer and negotiating best terms

SOP driven documentation and claims process

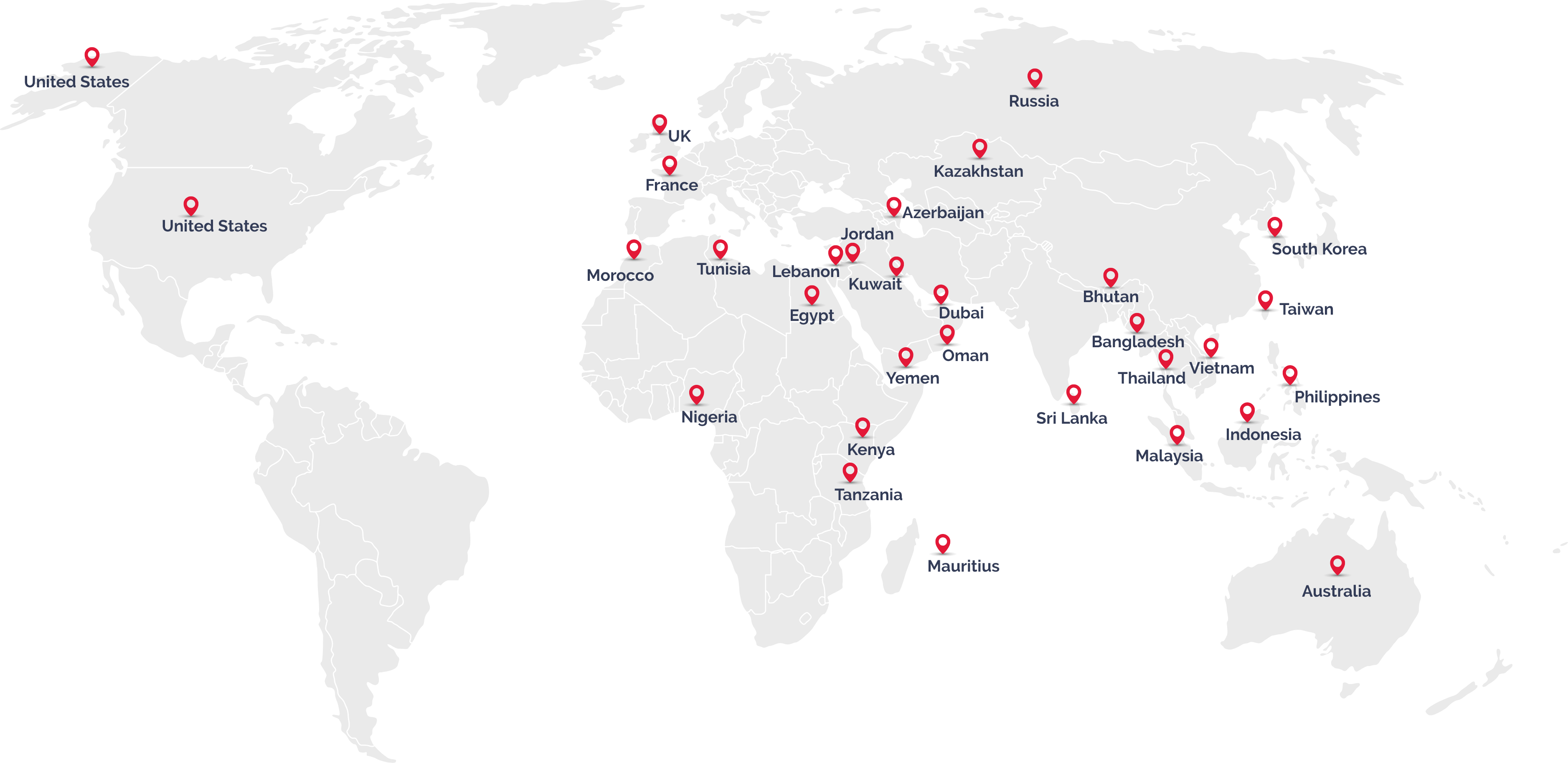

Business Presence Across the Globe

Our Team

Nitin Firke

Akash Soam

Bhushan Bhere

Joydeep Das

Pronoy Das

Contact Us

Please rotate your device

We do not support landscape mode yet. Please return to the portrait mode for the best experience.